Invoice financing for small business is a financial solution that enables small businesses to unlock cash flow by leveraging their outstanding invoices. This approach is especially valuable for small businesses that often face cash flow challenges and need immediate access to working capital. In this article, we’ll explore the ins and outs of invoice financing, its benefits, costs, and how to choose the right provider.

Learn more about online earning ideas

What is Invoice Financing for Small Business?

Invoice financing is a financial solution where businesses utilize their unpaid invoices to receive immediate cash. This practice aids small businesses in managing cash flow by converting outstanding invoices into working capital without the need to wait for customer payments.

Understand Deeply:

Understanding Invoice Financing: Imagine running a small business where your cash flow is tied up in unpaid invoices, leaving you unable to cover daily expenses or invest in growth opportunities. Invoice financing offers a lifeline by allowing you to sell these invoices to a finance company at a discount. In return, you receive a significant portion of the invoice value upfront, while the finance company takes on the responsibility of collecting payments from your customers. [Reference]

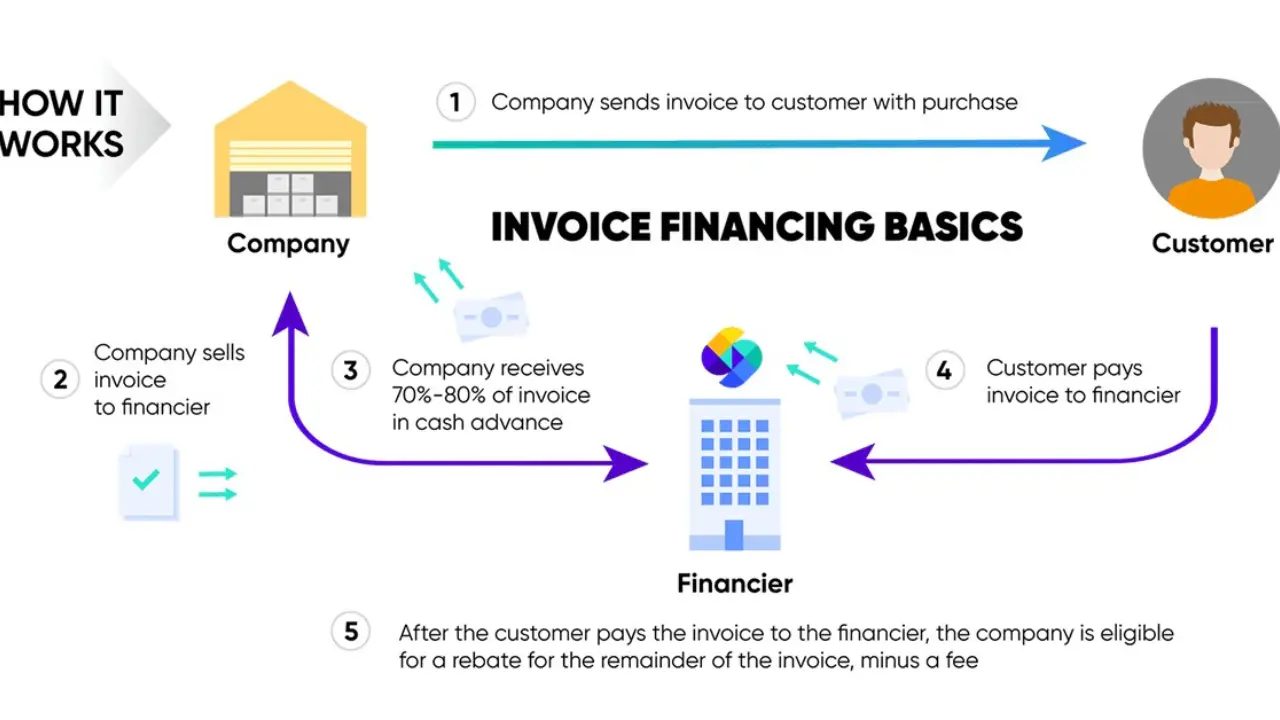

How Does Invoice Financing Work?

Invoice financing is a straightforward process that involves several key steps, allowing businesses to convert their unpaid invoices into immediate cash. Here’s a detailed breakdown of how it works:

- Business submits unpaid invoices to an invoice financing company.

- The lender verifies the invoices.

- The business receives 70-90% of the invoice value upfront.

- The client pays the invoice amount on the due date.

- The lender deducts a small fee and transfers the remaining balance.

For Example:

Consider Jane, who runs a small manufacturing business. She often faces cash flow challenges because her customers take 60 days to pay their invoices. By using invoice financing, Jane submits her unpaid invoices to a finance company and receives 85% of the invoice value upfront. This immediate cash infusion allows her to purchase raw materials, pay her employees, and continue her operations without interruption. Once her customers pay their invoices, the finance company deducts a small fee and remits the remaining balance to Jane. [Reference]

Benefits of Invoice Financing for Small Businesses

Invoice financing offers several advantages for small businesses, including:

- Improved Cash Flow Management: By converting unpaid invoices into immediate cash, businesses can better manage their cash flow and meet operational expenses.

- Access to Working Capital: Invoice financing provides quick access to funds, enabling businesses to take advantage of growth opportunities without waiting for customer payments.

- Reduced Credit Risk: The finance company assumes the credit risk, allowing businesses to focus on their core operations.

- No Collateral Required: Unlike traditional loans, invoice financing doesn’t require collateral, making it an attractive option for small businesses. [Reference]

Invoice Financing Types

There are four main types of invoice financing. Details are below

1. Invoice Factoring

- Lender buys the invoices and collects payment directly from clients.

- Suitable for businesses that prefer outsourcing payment collection.

2. Invoice Discounting

- Business retains control of customer payments and uses invoices as collateral for a loan.

- Ideal for companies that want to maintain customer relationships.

3. Spot Factoring

- Financing a single invoice instead of a batch.

- Useful for businesses with occasional cash flow gaps.

4. Whole Ledger Factoring

- Businesses finance all invoices continuously.

- Best for companies with high-volume invoicing. [Reference]

Invoice Financing Costs & Fees

Understanding the costs and fees associated with invoice financing is crucial for making informed decisions. Here’s a detailed breakdown of what you can expect:

| Company | Interest Rate | Loan Amount | Approval Time |

|---|---|---|---|

| Company A | 1-3% | $10,000 – $500,000 | 24 Hours |

| Company B | 2-4% | $5,000 – $250,000 | 48 Hours |

| Company C | 1.5-5% | $15,000 – $1M | 3 Days |

Compare Invoice Finance: Finding the Best Option

When looking for the best invoice financing solution, it’s essential to compare providers based on interest rates, fees, loan amounts, and approval speed. Here’s what to consider:

- Interest Rates & Fees

- Funding Speed

- Loan Amounts

- Reputation & Customer Service [Reference]

Invoice Financing Loan: How to Secure Funding

An invoice financing loan allows businesses to receive an advance on outstanding invoices. To qualify for this type of loan, follow these steps:

- Check Eligibility: Ensure your business has outstanding invoices from creditworthy clients.

- Choose a Lender: Compare different invoice financing companies based on interest rates and terms.

- Submit Invoices: Provide unpaid invoices for verification.

- Receive Funding: Get a percentage of the invoice value upfront.

- Repay the Loan: Once the client pays the invoice, the lender deducts their fee and transfers the remaining balance. [Reference]

Is Invoice Financing Right for Your Business?

Deciding whether invoice financing is the right choice for your business depends on various factors and your specific financial needs. Here are some considerations to help you make an informed decision:

- Cash Flow Needs

- Business Growth

- Creditworthiness

- Costs and Fees

- Customer Relationships

- Flexibility and Terms

- Operational Efficiency

For example: Mark, who runs a tech startup, found that invoice financing enabled him to hire additional staff and take on larger projects without worrying about cash flow constraints. By leveraging his outstanding invoices, he maintained steady growth and built strong relationships with his clients.

What is the difference between invoice factoring and invoice financing?

Invoice factoring and invoice financing both help businesses get cash from unpaid invoices, but they work differently:

- Invoice Factoring: The lender buys the invoices and collects payment directly from customers.

- Invoice Financing: The business retains control over collections and uses invoices as collateral for a loan.

How much does invoice financing cost?

The cost of invoice financing varies based on the lender, risk assessment, and funding terms. Generally, fees range between 1-5% of the invoice value. Some lenders may also charge additional setup or administrative fees. It’s essential to compare invoice finance providers to find the most cost-effective solution.